How to get health insurance as a locum tenens physician

January 20, 2026

For many physicians, locum tenens work feels like an ideal professional fit. It offers flexibility, variety, and greater autonomy. But as they start looking into it, one question begins to nag at them: What happens with my health insurance?

Fortunately, nothing about locum tenens work eliminates access to health insurance. It simply removes the intermediary: the employer. It requires a bit of an adjustment, but millions of people buy health coverage every year as independent contractors.

How health insurance works for locum tenens physicians

Most locum tenens physicians are 1099 independent contractors and don’t have access to employer-sponsored group insurance. Instead, they select their own plans, either through the ACA marketplace or directly from private insurers.

Where you work and how much you earn matter more than they did under employer coverage. Once you understand the basics, managing your own insurance becomes pretty straightforward.

Locum tenens health insurance options: What’s available

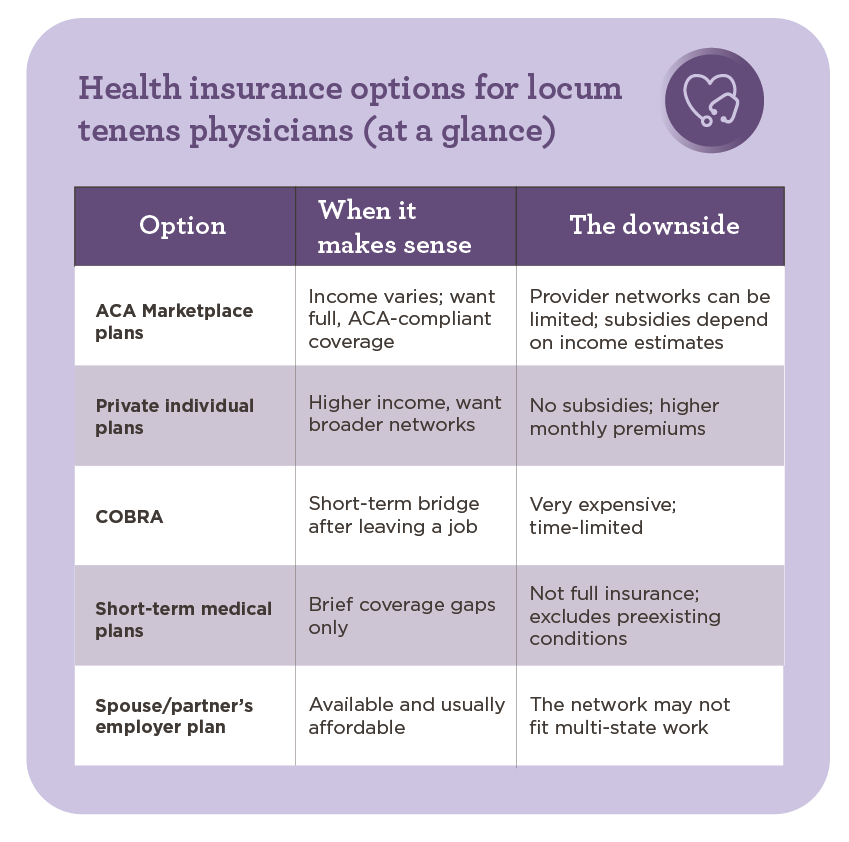

Locum tenens physicians can choose from various types of coverage.

ACA Marketplace plans

Several plans are available through the ACA exchanges for individuals and families. They cover essential health benefits and prohibit exclusions for preexisting conditions. Some include subsidies or tax credits based on projected household income, which can lower monthly premiums.

ACA plans tend to work best for physicians with moderate or variable income who want comprehensive coverage. Locum tenens physicians often qualify for partial subsidies even with relatively high earnings.

When enrolling, you’ll need to project your income for the upcoming year. Overestimating income usually means paying higher monthly premiums than necessary, with the possibility of receiving a refund at tax time if your actual income is lower. Underestimating income can reduce premiums upfront, but it may result in having to repay some or all of the subsidy when you file your taxes.

Health network design matters: Many ACA plans rely on state-based or regional networks, which can limit non-emergency care outside the network.

Many ACA plans qualify as high-deductible health plans. When paired with a Health Savings Account (HSA), these plans allow independent contractors to set aside pre-tax dollars for medical expenses. HSAs can help reduce taxable income while creating a flexible fund that carries over from year to year and can support both current healthcare costs and long-term savings.

Open enrollment for 2026 Marketplace coverage runs from November 1 through January 15. If you've missed the open enrollment period, you can only get a health plan if you qualify for the Special Enrollment Period. For 2026 Marketplace coverage, premiums (before subsidies) are estimated to increase by an average of 26%.

Private individual health insurance (off-exchange)

Private individual plans are offered directly by insurers, rather than through Healthcare.gov or state exchanges. They’re often quite similar to the ACA marketplace plans, but they don’t provide government subsidies, so premiums tend to be higher.

These plans typically have broader provider networks, which can be particularly beneficial for locum tenens physicians who frequently take assignments across state lines.

Private individual plans typically make the most sense for higher-income locum tenens physicians who receive little or no benefit from ACA subsidies and are more concerned with network access than with monthly costs.

Short-term medical insurance: Gap coverage only

Short-term medical insurance offers lower premiums and rapid enrollment, but these policies don’t meet the ACA’s minimum essential coverage requirements. For example, they typically exclude preexisting conditions and limit preventive services.

Duration varies by state, but coverage typically lasts only a few months. Short-term insurance works best as temporary gap coverage between assignments or while waiting for ACA enrollment; it’s not a long-term solution.

COBRA to tide you over

COBRA lets you continue your employer's group health plan for up to 18 months after leaving a job, but you'll pay the full premium plus a 2% administrative fee, which may make it more expensive than marketplace or private plans.

Other employer coverage

Some physicians join their spouse or partner’s employer-sponsored plan, which may be less expensive than purchasing an individual plan.

Add-on coverage every locum tenens physician should consider

You can add other types of coverage for an extra premium.

Dental and vision insurance: Dental plans typically cover preventive services immediately and major services after waiting periods. Vision plans cover exams, lenses, and corrective devices.

Disability insurance: For locum tenens physicians, disability coverage matters more than it did in employed practice. Short-term policies help during temporary illness or injury, and long-term coverage protects your income if you can’t return to work.

Life insurance: Life insurance is a good fit for physicians with financial obligations such as a mortgage or student loans, and those with dependents.

Supplemental insurance: Accident, hospital indemnity, and critical illness plans provide cash benefits following specific events. These payments can offset deductibles, travel costs, or lost income.

How to choose health insurance as a locum tenens physician

Choosing the right plan starts with the contours of your life, not the details of the policy. Family size, whether a spouse already has coverage, and any ongoing health needs can quickly narrow the field of workable options.

Then consider the way you work. Do you expect to practice steadily all year, or will your income fluctuate? Do you anticipate many assignments across state lines? You need a provider network that aligns with where you actually work. A health plan won’t do much good if its network excludes hospitals where you’re located, so consider how the plan treats non-emergency care out of state.

When thinking about cost, don’t stop at the monthly premium. Deductibles and coinsurance are also part of the calculation. Look at the out-of-pocket maximums; that’s what you may need to pay if you or a family member has a serious injury or illness. And don’t forget to review prescription coverage, especially for maintenance medications. Formularies vary, as do the prices patients pay.

Enrollment timing and how to avoid coverage gaps

ACA marketplace plans operate on a defined enrollment schedule. Outside of annual open enrollment, physicians can enroll only after qualifying life events, such as losing employer-sponsored coverage, relocating permanently, or adding a child to the household through birth or adoption.

Begin insurance planning at least 60 days prior to leaving W-2 employment. This allows time to compare options, estimate income, and align coverage start dates with assignment transitions.

Insurance brokers can help navigate income projections, state-specific rules, and network differences, particularly for physicians working across multiple states. Whether you enroll on your own or work with a broker, ACA marketplace plans typically require income estimates, recent tax information, and proof of prior coverage. Private off-exchange plans often require less documentation.

Common health insurance mistakes locum tenens physicians make

Perhaps the most common mistake locum tenens physicians make when purchasing their own insurance is related to timing. Coverage gaps tend to show up during transitions—between assignments or right after leaving employed practice—when enrollment windows don’t align with start dates. The same issue comes up with short-term insurance. Relying on this coverage longer than intended can create gaps or, at the very least, leave critical services uncovered.

Network limitations present a distinct set of challenges. Physicians sometimes choose plans without realizing how narrow the provider network is, only to discover—often too late—that non-emergency care isn’t covered in the places where they live or work.

Being able to estimate income can be a stumbling block. Failing to project income accurately or misunderstanding ACA subsidy eligibility can result in an unexpected tax bill. And it’s not just a problem during enrollment: Failing to update Marketplace income estimates midyear after a high-paying assignment can lead to a hefty subsidy repayment at tax time.

Locum physicians also make a mistake common among independent contractors: overlooking disability insurance. Not everyone needs it, but it plays a vital role in protecting income and is worthy of consideration.

Each of these missteps increases financial risk, but none are unusual—and all are easier to avoid with planning.

Health insurance shouldn’t stop you from going locum

Health insurance as a locum tenens requires a bit more attention. You can’t just enroll and forget about it until the next open enrollment. But the need to buy and manage your own health coverage shouldn’t stop you from going locum.

Locum tenens physicians still have access to solid insurance options, including ACA plans, private coverage, and supplemental policies that help fill gaps. Your coverage can stay consistent throughout the year, even if your work varies.

For physicians considering locum tenens, insurance doesn’t need to be the deciding issue. It’s one practical piece of a larger decision about flexibility, control, and how you want to practice—important, but not a reason to stop short.

Learn the logistics: How locums pay, malpractice, and taxes work for locum physicians

Checklist 1: Questions to ask when evaluating health insurance plans

Coverage scope

Does the plan cover my existing healthcare providers and specialists?

Which hospitals in the areas I work are in-network?

How does the plan handle out-of-network emergency care?

Are my current prescription medications covered? At what tier?

Does the network include providers in all states where I expect to work?

Cost structure

What's the monthly premium, and can I afford it during slower assignment periods?

What's the annual deductible, and how quickly could I meet it?

What's the out-of-pocket maximum?

What are my copays/co-insurance?

Income and subsidies (for ACA plans)

What's my projected annual income?

Do I qualify for premium tax credits based on that projection?

What happens if my actual income differs significantly from my estimate?

Should I adjust my subsidy throughout the year if income changes?

Plan features

Is this a high-deductible health plan that qualifies for an HSA?

What preventive services are covered at no cost?

How are telemedicine visits covered?

Special considerations for locum tenens work

Can I access non-emergency care when working assignments out of state?

Does the plan remain valid if I relocate temporarily for an assignment?

What happens to my coverage if I take time off between assignments?

Countdown to coverage: Health insurance enrollment timeline

60+ days before leaving W-2 employment

Review current employer plan coverage and end date

Research ACA marketplace plans vs. private individual plans

Estimate annual income for subsidy calculation

Identify must-have providers and check network participation

Calculate total potential healthcare costs under different plans

Determine if COBRA is a viable bridge option

30 – 45 days before coverage needed

Gather required documentation (tax returns, proof of prior coverage, ID)

Contact insurance brokers if you want their guidance

Compare at least 3 – 5 plan options across the marketplace and private insurers

Review prescription drug formularies for current medications

Check enrollment periods and qualifying life event eligibility

Confirm coverage start date aligns with employment transition

2 – 3 weeks before coverage begins

Complete application on Healthcare.gov, state exchange, or directly with insurer

Submit all required documentation

Set up payment method for first premium

Verify income projections one final time

Enroll in an HSA if choosing a high-deductible plan

Apply for add-on coverage (dental, vision, disability) if desired

1 week before coverage starts

Confirm enrollment and coverage effective date

Pay first month's premium if not already paid

Download insurance card or confirmation

Set up an online account with the insurer

Add calendar reminders for premium due dates

Verify primary care provider is accepting new patients

After coverage begins

Schedule preventive care appointments

Fill prescriptions to confirm coverage

Set up automatic premium payments if available

Add essential dates to calendar: renewal period, tax filing deadlines

Keep all enrollment documents and tax forms for year-end filing

Review coverage quarterly to ensure it still meets needs

ACA Open Enrollment period (typically November 1 – January 15)

Review current plan performance and costs

Compare with new plan options

Update income projections

Make changes if needed before the deadline

Visit the HealthCare.gov insurance exchange

In a recent CHG Healthcare survey of nearly 4,500 locum tenens physicians, 23% said they used HealthCare.gov to find and enroll in insurance. For many, the Affordable Care Act insurance exchange has made it easier to get health insurance on your own. What you might not know is that each health insurance plan offered through the exchange must include:

Prescription medications

Lab tests

Outpatient care

ER visits

Preventive care

Inpatient hospital care

Mental health and substance abuse disorder care

Prenatal and postnatal care

Dental and vision care for kids

Help recovering from an injury or treating a chronic illness or disability

Healthcare.gov shows you the available health insurance plans in your state, and then you can compare the gold, silver, and bronze plans to see which coverage is best for your family and your budget. It’s helpful to look at what you spent for healthcare over the past several years to get an idea of the coverage you really need.

Look at professional associations and groups for coverage

If you’re already a member of the American Medical Association (AMA), it’s worth looking into their healthcare plans, including life, disability, auto, home, and hospital income insurance. You may also qualify for dental, vision, and long-term care insurance as a member of AARP. Another option you may consider for insurance is the National Association for the Self-Employed (NASE). NASE members have access to many health benefits, including health, vision, dental, and critical illness insurance.

Consult a local independent insurance agent

If you’re looking for personalized help with your insurance, that’s where a local independent insurance agent comes in. Check out Healthcare.gov ’s Find Local Help to identify agents (generally paid by insurance companies) or assisters (trained to help you enroll in a health plan) in your neighborhood who can help. You can also visit the National Association of Insurance Commissioners website to check out your state’s insurance department.

While acquiring locum tenens health insurance takes more effort than joining an employer’s plan, you have more options and flexibility. You can customize it to your family’s needs, and you'll only need to buy the coverage you want. Plus, getting help can make buying your own insurance easier and more affordable than you may think.

Questions about locum tenens? Give us a call at 800.453.3030 or view locum tenens job opportunities.